Sole Proprietor Income Tax Malaysia

SSM for Sole Proprietor Partnership Private Limited Co. Income tax return for individual who only received employment income Deadline.

Malaysia Personal Income Tax Guide 2021 Ya 2020

Registration of Sole Proprietorship Partnership.

. Sole Proprietor vs LLP vs General Partnership vs Company. 30062022 15072022 for e-filing 6. Real property means any land situated in Malaysia and any interest option or other right in or over such land.

The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. Section 138A of the Income Tax Act 1967 ITA provides that the Director General is. A company limited liability partnership or a sole proprietor may incur adjusted business losses after deducting.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Latest income tax notice of assessment or latest 6 months CPF Contribution history statement. Self-Employed defined as a return with a Schedule CC-EZ tax form.

41 A person ie. Form B Income tax return for individual with business income income other than employment income Deadline. Form P Income tax return for partnership Deadline.

Sole ProprietorPartnership vs Sdn Bhd. Online is defined as an individual income tax DIY return non-preparer signed. Standard Chartered Bank Malaysia Berhad makes no warranties representations or undertakings about and does not endorse recommend or approve the contents of the 3rd Party Website.

Different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Call us 603 7729 7018 l.

If youre an LLC with more than one owner youre automatically taxed as a partnership and should select the LLC box using the letter P for partnership. Prior to these dates the special rate was 8. The SME company means company incorporated in Malaysia with a paid up capital of.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Online competitor data is extrapolated from press releases and SEC filings. Resident means resident in Malaysia for the purposes of the Income Tax Act 1967 except that references to basis year or basis year for a year of assessment in that Act shall be read as references.

For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24. Setting up new company company audit income tax accounting. Self-Employed defined as a return with a Schedule CC-EZ tax form.

Expenditure that would otherwise fall into the special rate pool is eligible for the AIA with the exception of cars and certain other exclusions see the. 1 online tax filing solution for self-employed. Standard Chartered Bank Malaysia Berhad makes no warranties representations or undertakings about and does not endorse recommend or approve the contents of the 3rd Party Website.

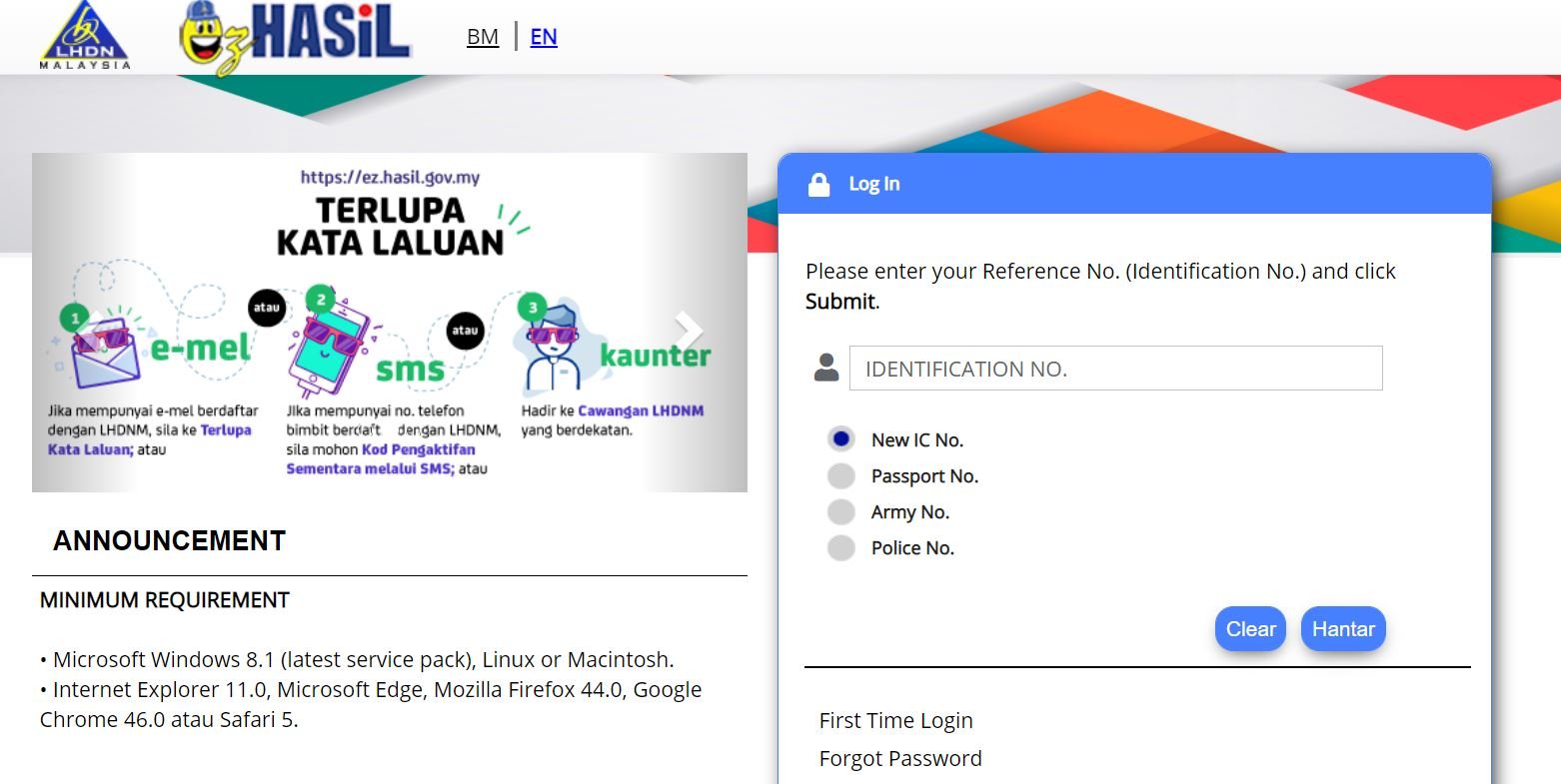

INLAND REVENUE BOARD OF MALAYSIA. Memorandum and Articles are legal documents of a company that required to be lodged with Suruhanjaya Syarikat Malaysia SSM upon the registration of a company. Latest income tax notice of assessment or latest 6 months CPF Contribution history statement.

30 JUNE 2022. Of the Income Tax Act 1967. In the forms tax classification box if youre taxed as a disregarded entity see the definition above check the individualsole proprietor box not the limited liability company box.

30042022 15052022 for e-filing 5. 1 online tax filing solution for self-employed. SSM for Sole Proprietor Partnership Private Limited Co.

The annual writing down allowances available on the special rate pool is 6 from 1 April 2019 corporation tax and 6 April 2019 income tax. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. An incentive on income tax is given for 5 years which is calculated based on a formula.

Translation from the original Bahasa Malaysia text.

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

No comments for "Sole Proprietor Income Tax Malaysia"

Post a Comment